As a beginner forex trader, you must familiarize yourself with the forex market first so you can efficiently navigate through the advantages and risks of forex trading. With that said, before we explore the potential benefits and risks of forex trading, let us learn more about what forex trading is.

Read on to learn more.

Forex Trading – A Basic Overview

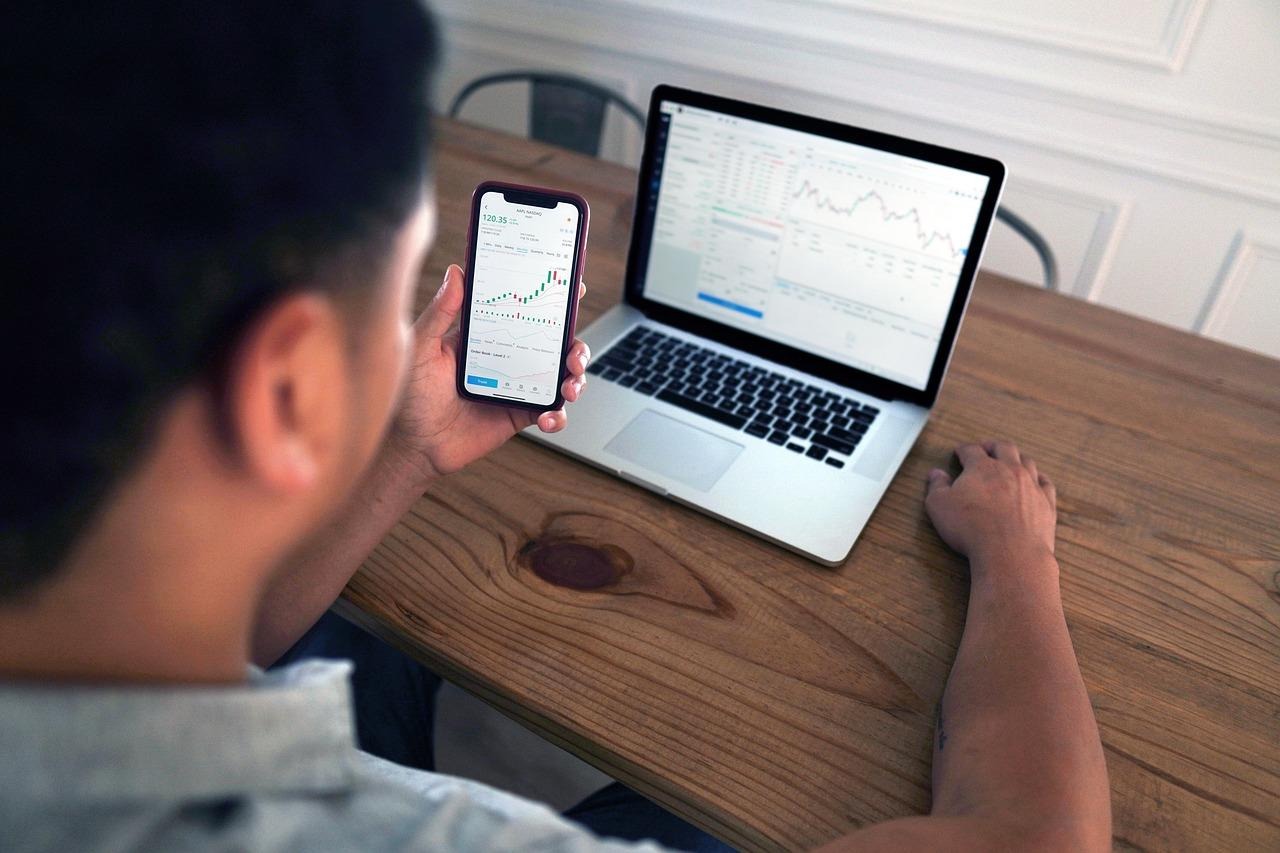

In simple words, forex trading is about the art of selling and purchasing national currencies in an international market. By selling and purchasing international currencies, a forex trader aims to profit from changes in their relative values. With that said, you should know that forex trading is the most liquid and the largest financial market in the world. Trillions of traders enter the forex market every day to buy one currency and sell another.

Potential Advantages of Forex Trading

Let us explore the potential benefits of forex trading.

You Can Trade Five Days A Week

If you are busy, such as having responsibilities outside of your job, and you still want to become a trader, then forex trading is right for you, as it offers the benefit of trading five days a week. Compared to the stock trading market, the forex market does not operate within strict time constraints but stays open five days every week, which makes it perfect for people juggling jobs and taking care of other life responsibilities.

You Can Buy and Sell Almost Instantly

With forex trading, you can access exceptional market depth. The forex market establishes a remarkable environment of fluidity, as trillions of exchanges have predicted, which provides the ability to buy and sell foreign currencies almost instantly without having to go through major price disruptions. Now, if you look at it, you realize that this exceptional market depth offers competitive pricing spreads, which further lowers trading expenses.

Forex is An Approachable Avenue

Forex trading is for everyone, which means that this trade in the market is not reserved for the affluent or professionals alone. You should know that modern forex trading platforms have actually lowered their threshold for participation. What this means is that beginner traders with modest initial deposits, even less than $100, can become forex traders and start trading instantly.

Potential Downsides of Forex Trading

Let us explore the potential downsides of forex trading. The first risk that you should know about for its trading is that you are at a higher risk, which means that while you can earn great profits, you should also be prepared for making losses. Another potential risk with forex trading comes down to market volatility, as the forex market is incredibly sensitive to global political events, which is why you can expect unpredictable price fluctuations that can result in substantial losses.

Who Can Become A Forex Trader

If you have done your research and developed a deep understanding of forex trading and geopolitical factors that affect this market, then you are indeed ready to become a forex trader. Likewise, you should be able to showcase a solid understanding of market fundamentals, along with possessing strong mathematical and analytical skills. Discipline and psychological resilience are important characteristics to have for successful forex traders.